Surgical robotics have moved from the margins to the centre of hospital care. In 2025, researchers at Johns Hopkins University made headlines by demonstrating a robot that could autonomously perform part of a gallbladder removal on a lifelike patient, trained directly from surgical video footage. Today, AI models are guiding robotic arms via voice or touch, enabling these systems to assist in complex procedures with increased precision. With hospitals under pressure to deliver more with fewer resources, adoption of these technologies is accelerating .

As Joey Mason, Venture Partner at Claret Capital Partners noted at this year’s LSX World Congress, the scale of investment is “unprecedented” and the shift is no longer theoretical: “These technologies are now genuinely moving the dial on safety, workflow efficiency, and training. We see robotics becoming standard-of-care for multiple indications, not just a luxury for elite centres.”

Market Acceleration and Competitive Dynamics

The market for surgical robotics is rapidly expanding, with several major players now competing for dominance. While Intuitive Surgical still has a significant installed base, newer entrants such as Stryker (Mako), Zimmer Biomet (ROSA), Medtronic (Hugo, Mazor), and UK-based CMR Surgical (Versius) are actively challenging its position. CMR Surgical, highlighted by Mason as a leading European challenger, recently secured FDA clearance and is expanding into the US and Asia, following in the footsteps of other European companies such as MMI from Italy and France’s Moon Surgical.

Start-ups are also raising substantial capital, ForSight Robotics and Cornerstone Robotics are two examples, further increasing competitive pressure. The clinical data is now strong enough that both NHS Trusts and private hospitals are budgeting for robotic suites, which marks a shift from robotics as a premium product to a standard line item in hospital capex. Despite strong competition, the sector remains underpenetrated, at less than 10% according to a recent report by PatentVest; only a small fraction of major surgeries in the US currently use robotics, signalling room for significant growth as approvals and adoption increase.

Real-World Impact: Evidence and Adoption

The clinical evidence for using robotics in surgery is mounting. The latest robotic systems are reducing tissue trauma, speeding up recovery, and improving outcomes for patients. Hospitals now operate with multiple robots, and new models have demonstrated a marked reduction in tissue damage and faster patient discharge.

At the same time, robotic systems are being integrated into increasingly specialised fields. Claret’s 2018 investment in SpineGuard is a case in point: SpineGuard’s navigation and robotics platform for spinal surgery provides real-time feedback to avoid nerve injury, and is now being incorporated into robotic-assisted arms. This kind of integration is designed to assist surgeons, reduce human error and make surgery safer across a wider range of procedures.

Looking Ahead

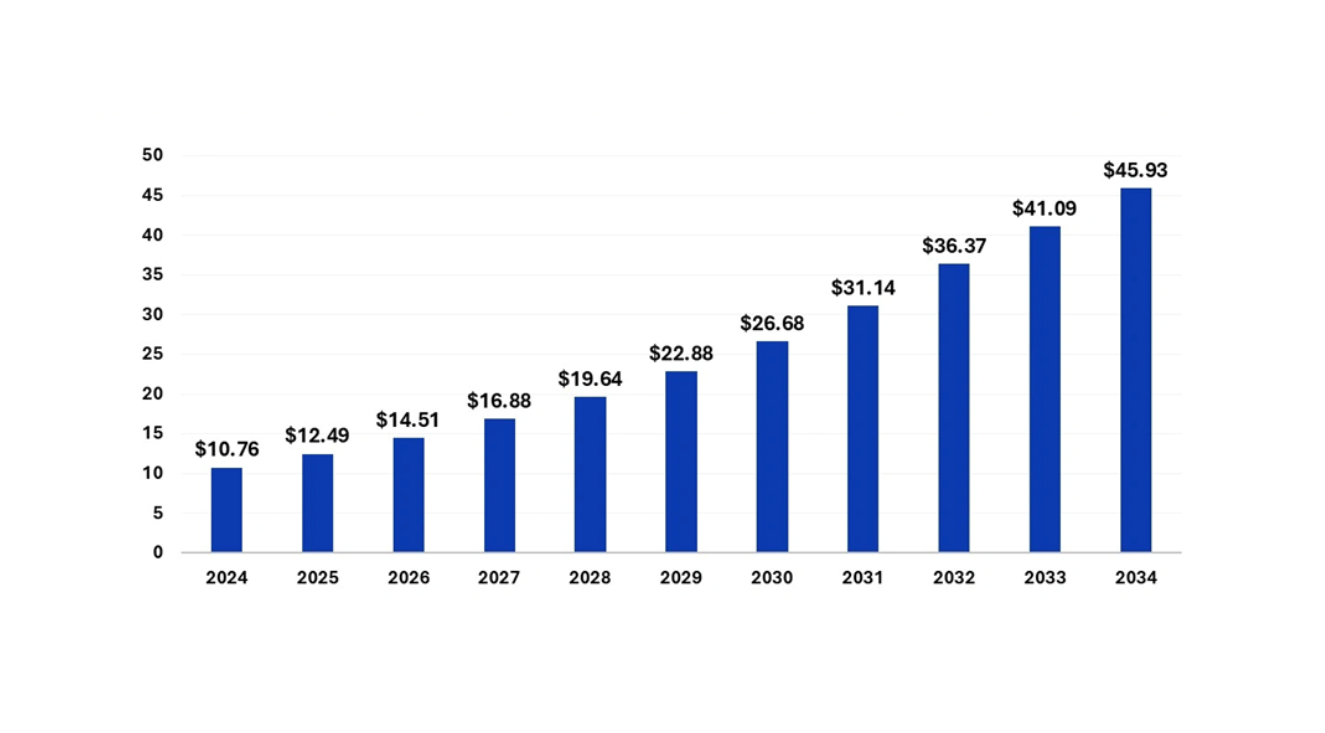

Robotic surgery is set to move from niche to mainstream. AI-powered systems are designed to learn from each procedure and become more autonomous over time, potentially helping to address workforce shortages and bring expert-level care to more hospitals. Market forecasts suggest global surgical robotics will grow from $12.5bn in 2024 to $45.9bn by 2034[1], fuelled by both public and private investment. Robots will soon be a routine part of surgical practice, delivering gains in accuracy, patient recovery, and hospital productivity.

Cost, training, and regulation are still barriers, but the direction is clear: robotics, powered by AI applications, is now a significant life science trend, with the UK and Europe producing genuine competitors to established US firms.