Claret Capital Partners (“Claret”) has been providing growth funding to technology and life sciences companies for over 13 years. In that time, our funds have backed more than 190 companies and deployed over €1.2 billion in capital, making us one of the most experienced players in the European growth lending space. We’ve seen the weird, the wonderful, and everything in between across the European venture ecosystem. Over the years, our team has also analysed data from thousands of companies and learnt a lot about what works – both for us and for the borrowers – and just as importantly, what doesn’t.

To give you a sense of the volume of companies we’ve looked at: in the last 12 months alone, (since Jul-25) we have reviewed over 1,000 businesses and issued term sheets to around 60 – a 6% hit rate. The good news is however, that there are clear steps you can take to increase your chances of success, get better terms, and assess if we’re the right fit for you.

While this piece focuses on raising venture debt, a lot of the advice applies to equity raises too.

- Understand the Product

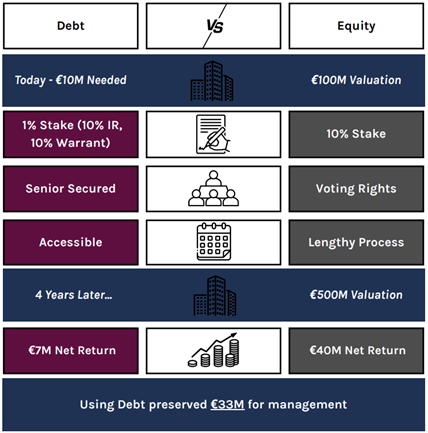

Venture debt can be an excellent way to avoid dilution and lower your cost of capital. If you’ve studied finance, this won’t be news—but here’s a quick example:

Source: Claret Capital Partners

While this sounds great, and while debt is cheaper, it is not as flexible: the obvious fallback is that when things don’t go as well, the lender still expects repayment. That’s why debt isn’t always the right tool for businesses that have little visibility of revenues or performance into the next 12 months.

At Claret, we usually focus on Series A+ companies with at least €3M in revenue over the past year. Our experience, through the good and bad, is that these types of businesses tend to have a better product market fit and have more visibility of what things will look like in the future, making them more suitable for debt financing.

- Fail to Prepare, Prepare to Fail

Talk to any advisor or banker and they’ll tell you: if you want a smooth process, get your house in order before you start.

Here’s what we expect to see (and you’d be surprised how many companies don’t have these ready):

- Your latest investor presentation: What problem do you solve? How do you solve it? How do you monetise?

- A monthly financial model in Excel covering:

- The past 24 months and the next 24 months

- P&L, cash flow statement, and recent balance sheet

- Monthly billing by customer – we want to see top customers, churn, NDR, and customer profiles. Even if you’re not SaaS, recurring revenue or repeat orders are useful to show.

- Management and founder summary: management history; relevant experience; are you a repeat entrepreneur with previous exits?

- A current cap table with round details and amounts invested by each investor

- Unit economics (especially for consumer companies): LTV, CAC, retention, repeat orders, renewals

Information bias is real, and we are all human. Clear, easy-to-digest information saves time, avoids endless clarifications, and makes everyone happier.

Finally, try and keep your forecasts up to date – missing plan materially the month after sharing it can erode hard-earnt goodwill quickly.

- Timing Matters

As the old saying goes: “A bank will lend you money if you can prove you don’t need it.”

If you’re down to your last couple of months of runway, this isn’t usually the best signalling for lenders. But on the flip side, raising debt too early means paying interest when you don’t need it.

Certain lenders in the ecosystem need to see 9 to 12 months runway which is not the position of the Claret funds, but it can decrease the number of offers you might expect to get.

If you think of debt as a last resort, then it’s likely you’re not going to be successful in raising it.

- Find the Right Lender

All money may be green, but not all lenders are created equally…

- Venture debt funds usually offer more flexible terms, require less equity alongside the debt, and impose fewer covenants and restrictions.

- Banks can sometimes offer cheaper rates but tend to have higher cash balance requirements and usually need a recent equity raise.

Remember banks want your business for other services like FX, deposit accounts and credit cards, whereas funds want to make money from the loan and any upside (which aligns them with all the shareholders). Pick your poison.

When we invest in companies, we place a lot of importance on speaking to some of your customers and board members. This should be similar when picking a lender, reach out to some of their existing portfolio companies or ask your board members for advice or referrals. We are always happy to introduce you to our portfolio.

- Be Transparent and Strategic

Lenders aren’t the biggest fans of surprises. Be upfront about risks and how you plan to mitigate them. Show us how the debt will help you hit key milestones – launch a product, accelerate clinical trials, grow revenue and hire key people. The clearer the roadmap, the more confidence we have in your ability to use capital wisely.

Final Thoughts

Raising venture debt isn’t just about securing cash, it’s about finding the right partner to support the next stage of your growth journey. With good prep, a strong story, and the right timing, venture debt can be a powerful tool, saving founders and early investors significant dilution and money.

Author: George Morgan, Claret Capital Partners